wyoming llc tax rate

The average property tax rate is only 057 making Wyoming the lowest property tax taker. Up to 25 cash back The tax is calculated at a rate of two-tenths of one mill on the dollar based on the value of your LLCs assets located in Wyoming.

Tax Benefits Of Living In Wyoming Wyoming Real Estate Blog

For residential and commercial property the tax collected is 95 percent of the value of the property.

. With corporate tax treatment the LLC must file tax return 1120 and pay taxes at the. Wyoming Sales Tax Rates Wyoming does have sales tax. An LLC may elect to be treated as a corporation for tax purposes by filing IRS Form 8832.

Commercial residential and other properties pay tax at the rate of 95 percent. If you make 70000 a year living in the region of Wyoming USA you will be taxed 8387. As the birthplace of the LLC with a business-friendly tax system Wyoming is a great.

This is the state. A home business grossing 55000 a year pays 000 A small business earning 500000 a year pays 000 A corporation earning 10000000 a year pays 000 12 - Wyoming Nonprofit Tax. This will cost you 325 for a corporation or an LLC.

If there have not been any rate changes then the most recently dated rate chart reflects the rates currently in effect. Although we are not tax or legal professionals weve helped form a lot businesses and want to share our knowledge and experience. Wyoming taxes industrial property at the rate of 115 percent.

The tax is either 60 minimum or 0002 per dollar of. Tax rate charts are only updated as changes in rates occur. We include everything you need for the LLC.

Wyoming ranks in 10th position in the USA for taking the lowest property tax. With corporate tax treatment the LLC must file tax return 1120 and pay taxes at the 2018 corporate tax rate of 21 percent. Youll withhold 765 percent of their taxable wages and your employees will also be responsible for 765 percent totaling the current federal withholding rate of 153 percent.

Wyoming has a 400 percent state sales tax a max local sales tax rate of 200 percent and an average combined state and local sales tax rate of 522 percent. Wyomings Sales and Use Tax Wyoming charges a sales and use tax of 4 for which you will need a license to collect if you sell physical goods andor provide certain types of services. Your average tax rate is 1198 and your marginal tax.

Wyomings pioneering past led it to become the first state to create the LLC or limited liability company. Refund of Unemployment Credit In some instances employers may. Wyomings tax system ranks.

Wyoming Income Tax Calculator 2021. Each year youll owe 50 to the State of Wyoming to keep your Wyoming company. If you have questions about potential rates for a new employer please call the Unemployment Tax Helpline at 307-235-3217.

There is a minimum license tax is. When it comes to income taxes because LLC members are treated as self. For industrial lands this percentage goes up to 115 percent.

In Wyoming the self-employment tax rate is now 153 percent. When calculating how much self-employment tax you owe youll be able to deduct part of your business.

Corporate Tax In The United States Wikipedia

7 Benefits Of Starting An Llc Llc Benefits Truic

Free Llc Tax Calculator How To File Llc Taxes Embroker

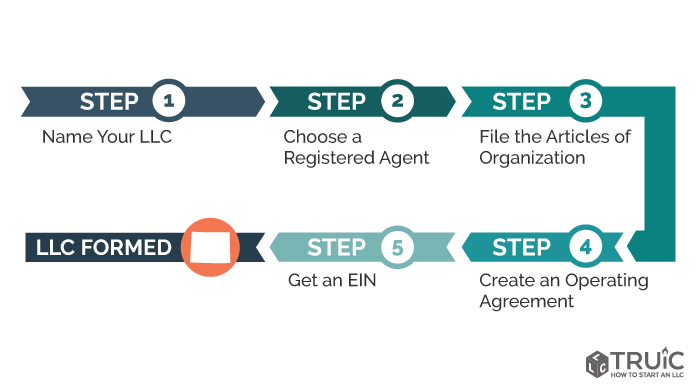

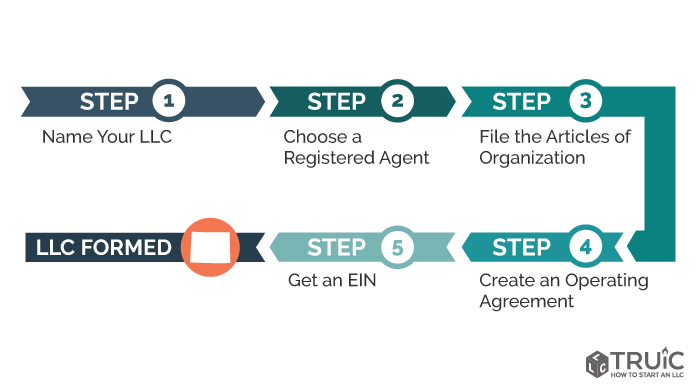

Wyoming Llc How To Start An Llc In Wyoming Truic

How To Pay Your Wyoming Llc Annual Fee Doola Blog Doola Blog

How To Form A Wyoming Llc 2022 Guide Llc University

Benefits Of A Wyoming Llc Cost Effective Asset Protection

Laying The Foundation Funeral Home Consulting

Wyoming Income Tax Calculator Smartasset

Wyoming 2022 Sales Tax Calculator Rate Lookup Tool Avalara

How To Form A Wyoming Llc 2022 Guide Llc University

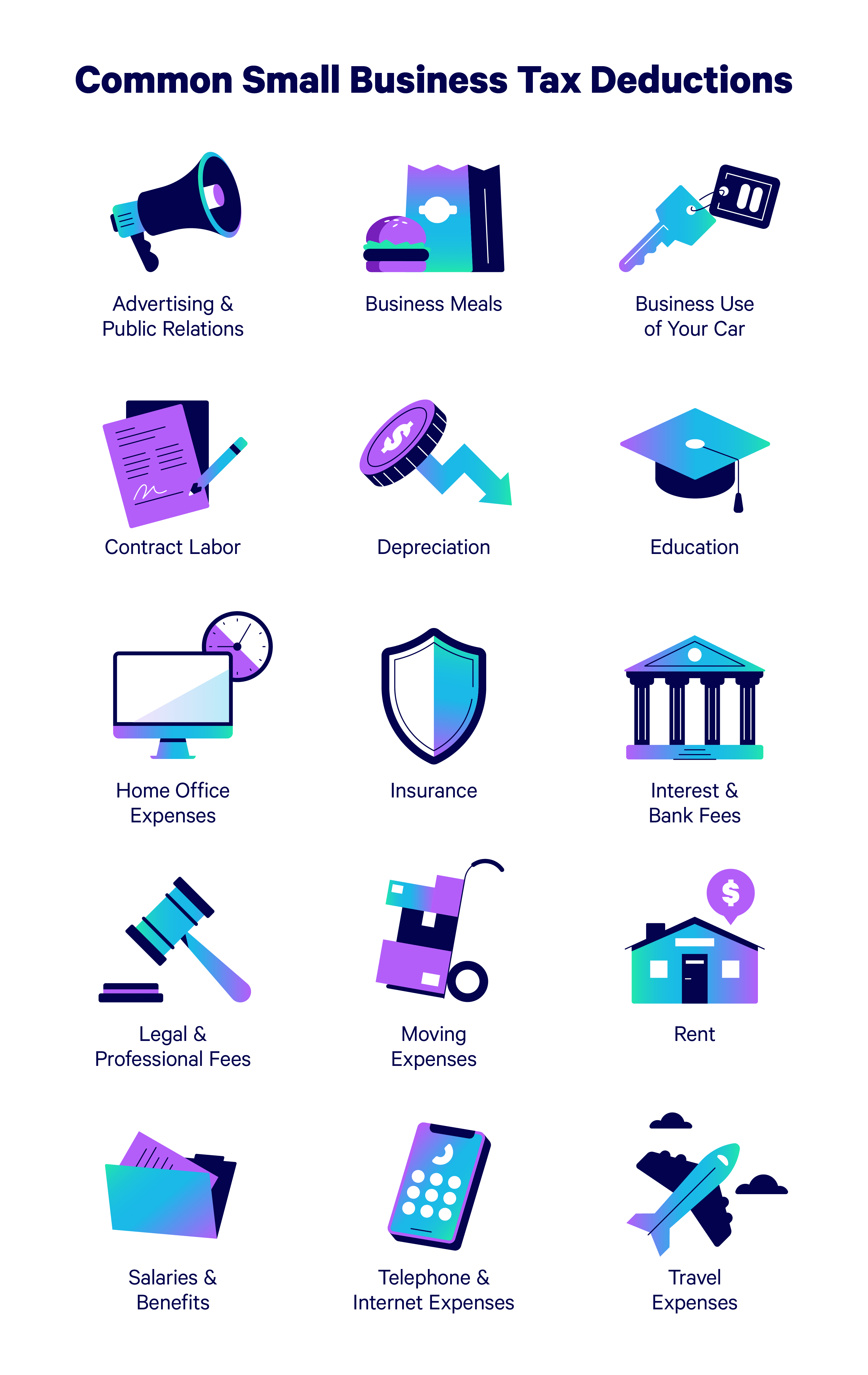

Llc Tax Calculator Definitive Small Business Tax Estimator

Llc Tax Calculator Definitive Small Business Tax Estimator

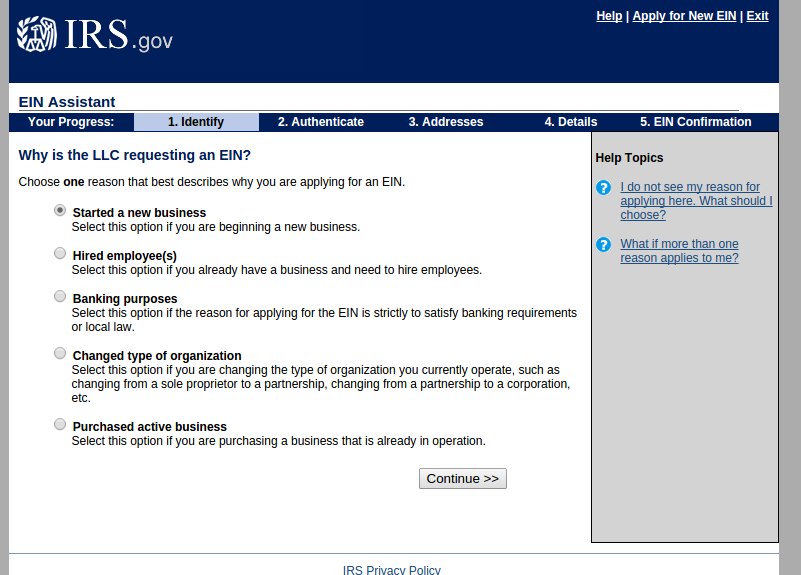

How To Get A Wyoming Based Ein Number For Free With The Irs

Should You Form An Llc In Delaware How To Decide Where To Register An Llc Gusto

Free Llc Tax Calculator How To File Llc Taxes Embroker

Using A Wyoming Llc As A Holding Company

Llc Vs S Corp The Difference And Tax Benefits Collective Hub

Wyoming Certificate Of Authority Foreign Wyoming Corporation